Weekly Credit Crunch 31st October 25

This Week’s Credit Crunch, A Very Special Edition 🎉

Two years ago today, I launched The Brokers' Bible , a solo online venture built from pure passion to serve brokers. What started as a small resi lending resource has grown into something so much bigger.

Since then, I 've built our own AI chatbot, added commercial and business lending policies, hosted Coffee & Credit with Kath sessions, launched training webinars, and rolled out weekly Credit Crunches and monthly social media kits. It’s been wild.

My mission from day one was clear :go big, go bold, and don’t swim in the sea of same. I’ve always dreamed big, but I didn’t expect to be approached by LMG with an acquisition proposal. That moment changed everything.

Working with the largest aggregator in the country was equal parts exciting and nerve-wracking, but after 20 years of connection and trust, it just made sense. Now, I get to be part of a team with incredible talent, support, and shared vision.

It’s been emotional, full of lessons, mistakes, and milestones but above all, gratitude. To every lender, BDM, broker, and member who’s been part of this journey: thank you.

The Brokers' Bible may now sit within the LMG family, but I’m still here driving development, steering innovation, and making sure this engine keeps getting bigger and better.

Watch this space… the best is still ahead. 💥

💜UBank

Brand NEW – 90% NO LMI for Owner Occupied & Investment Loans!🙌

-

90% LVR available from 30 October 2025

-

No LMI or risk fee charged

-

Owner Occupied and Investor P&I purchase loans only

-

Loan terms: up to 30 years

-

Max loan amount: $2M (for >85% LVR)

-

DTI up to 8 (discuss with BDM if >6)

-

Note: Alternative Refinance Assessment applications remain capped at DTI 5

🖤 Macquarie Bank

Company/Trust Borrower Changes – Effective 31 October 2025 (absolutely devo! 😭)

Macquarie will pause all new lending to trusts and companies from Friday 31 October 2025.

No new home loan applications will be accepted under these structures until further notice.

💛 Commonwealth Bank (CBA)

Child Maintenance Verification – Effective 31 October 2025

CBA is updating requirements to verify child maintenance commitments and income, aiming for a smoother process and better customer experience.

Key updates:

-

Simplified document requirements

-

Removal of “court ruled” vs “non-court ruled” definitions

-

Aligned requirements when using child maintenance as income

💡 CBA – HELP Debt Repayment Changes

-

Systems updated in August to automatically apply new HELP debt methods.

-

ATO calculators have not yet been updated, so figures may differ.

-

Manual calculations aren’t required — CBA systems now apply the new thresholds automatically.

-

Before the government applies the 20% HELP debt reduction, brokers may manually adjust balances shown on myGov/ATO statements.

💚 CBA – Savings & Equity Uplift

Updates provide extra clarity around:

-

Gift letter requirements

-

When and why the one-month review is required for verifying savings/equity

💙 AMP Bank

SuperEdge SMSF Lending Product – Coming Soon

-

AMP is re-launching its SMSF home loan product, SuperEdge, aimed at pre-retirees and retirees seeking more control over their super investments.

-

Target launch: Q1 2026

-

Aligned with AMP’s focus on helping Australians build retirement wealth through property.

🏠 Paramount

New Lo Doc – Commercial

-

Up to 80% LVR

-

Loan amounts up to $3M (higher considered)

-

30-year loan term

-

No annual reviews

-

No clawback

-

No IO loading

💙 MA Money

Increased Loan Size Limits – Category 1 Non-Metro Locations

Effective 3 November 2025:

-

Residential loans: up to $5M

-

Expat loans: up to $5M

-

Non-Resident & SMSF loans: up to $2M

This brings Non-Metro Category 1 limits in line with Metro. Regions like Byron Bay, Coffs Harbour, and Toowoomba are included.If you’re unsure which category applies to a location, you can check using our Postcode Lookup Tool.

💖 ME Bank

$3,000 Refinance Cashback Offer

Turn a refinance into a win:

-

Apply from 27/10/2025 and settle within 120 days

-

Refinance from another eligible lender

-

Min loan: $700k

-

LVR: below 80%

-

Offer open to both Owner-Occupiers and Investors

💰 Switch and save — full T&Cs on the Broker Portal.

❤️ Pepper Money

November Webinars – Specialist Lending Solutions

Join Pepper for two practical webinars helping brokers handle complex scenarios and unlock new income streams.

🗓 11 November | 1:00–2:00pm AEDT

Topic: Specialised Lending Solutions

-

Confidently position non-bank options

-

Practical tips from experienced brokers

-

Market insights from Herron Todd White on areas impacted by adverse credit

🤝 Members We Helped This Week

💡 Scenario 1 – ABN Longevity Check

Member: Other than Better Choice and Bendigo Bank (I think), are there any other lenders who will take an ABN of 16 months in longevity? Not really wanting the likes of Think Tank, Bluestone etc. if I don’t have to...

TBB:We identified 10 lenders who can assist with ABNs of 16 months, plus 2 more with strong policies for 18-month ABNs..(Sometimes you just need a sanity check — even experienced brokers need help.) Suggested Next Step:

Explore the “ABN Less than 2 Years” module inside The Brokers’ Bible for detailed lender comparisons and documentation requirements (Full Doc vs Alt Doc).

🔗 ABN Less than 2 Years Module

💡 Scenario 2 – Partner Income Policy (HR Letter Acceptance)

Member : Westpac have a policy whereby they accept a letter from HR for partners of select large Law/Accountancy/Consultancy firms. Do any other lenders have a similar policy? It’s particularly helpful for new partners with guaranteed drawings. Unfortunately, my client doesn’t want to go to Westpac.

A (TBB): This one took some extra digging. We didn’t have a single clear policy to reference, so we relied on targeted AI questioning and cross-referenced lender policies to verify. After a full deep dive, we identified three lenders that may be suitable for new partners with guaranteed drawings.

It was a complex piece of research that would normally take 3–4 hours, but using our AI tools and policy intelligence, we nailed it in just 30 minutes.

What a day in Adelaide! ☀️

I loved catching up with so many amazing brokers and BDMs at the LMG PD Day on Wednesday. The room was absolutely buzzing.

It was such a great chance to showcase the brand new LMG Zeus Streamlined Refinance product, BOLT ⚡️, and share what’s new inside The Brokers' Bible.

Big thanks to everyone who stopped by for a chat — and a special shoutout to Adam Simpson, our keynote speaker, for his candid insights, wise words, and plenty of laughs along the way.

So proud to see the energy, collaboration, and passion from our South Australian network.

What a community. 💛

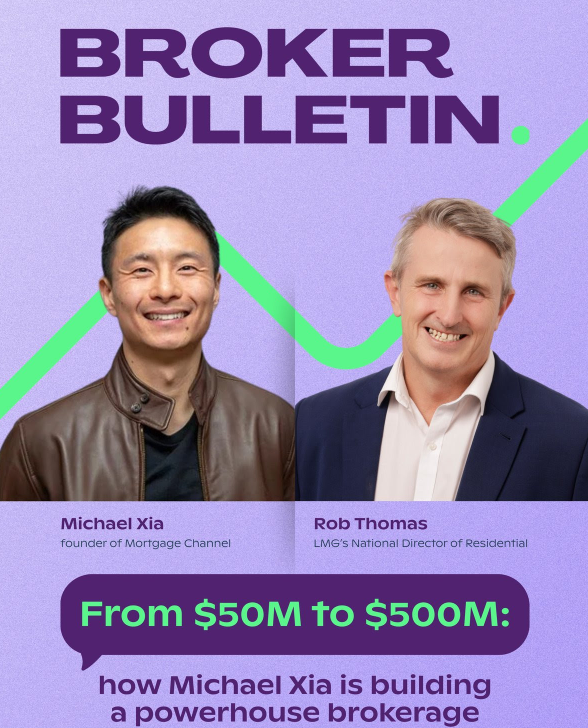

🎧 Podcast Pick of the Week – Real Talk with Michael Xia

I absolutely loved this chat, it’s real, raw, and just so relatable. Michael’s gratitude for his mentor (who was also his broker!) really stood out. You can hear the respect and humility in the way he talks about learning, listening, and genuinely understanding his clients , not just what they say they want, but what really drives them.

He doesn’t shy away from the tough stuff either , the early grind, the long nights, the self-doubt, the knockbacks. All the messy parts that shape who we become as brokers. And somehow, he makes it all sound funny and human.

From humble beginnings to settling $490 million with a team of 18 offshore, he shares what it takes to grow staying aligned with your clients, walking the same path they’re on, and keeping your focus on doing the right thing and understanding each clients needs and goals. Because when you do right by your clients, everything else follows. Honestly, this one’s a must-listen. It’s full of laughs, lessons, and a whole lot of heart. 💛

https://open.spotify.com/episode/7r5sNpskTFLPC8R5BxS8KZ?si=bd50b08d69274c46

That's it from me this week, see you next Friday Finance Friends!!

NOT A MEMBER YET?

Join today with our 14-day free trial, month by month membership. Cancel anytime! Individual memberships start at $37 per month. Access on the go, 24/7 with our mobile APP and your research sidekick, Brokerchat.AI. What are you waiting for?