Weekly Credit Crunch Friday August 1st 2025

🎉 Exclusive for LMG Brokers — 6 Months FREE Membership!

Starting today, LMG brokers across Australia get complimentary access to The Brokers’ Bible for a full 6 months — no catches, no contracts.

That means unlimited policy access, instant AI-powered scenario help with BrokerChat.AI, and all the time-saving tools you need to smash through credit hurdles faster.

💥 One login. 170+ lender policies. Zero stress.

📬 Watch out for an email from LMG with everything you need to get started.

The offer is only available from today — and your free access ends January 31st, 2026, no matter when you jump in.

So the sooner you join, the more you save! 🙌

👉 Your free membership is now live — dive in and make the most of it!

CBA -Policy Update: Expanded Access to LMI/LDP Waivers (Effective 30 July 2025)

Great news — CommBank is making it easier for your professional clients to qualify for LMI/LDP waivers. From Wednesday 30 July 2025, the following updates will apply:

-

Pharmacists

✅ Minimum gross income threshold reduced from $150,000 to $100,000 per eligible applicant. -

Medical Professionals

✅ Now includes those with limited registration types (e.g. postgraduate training, supervised practice). -

Banking Professionals

✅ No longer required to have salary credits to a CommBank account before settlement — giving clients more flexibility. -

Judges & Magistrates

✅ Now eligible by providing any ONE of the following:-

Commission letter

-

Appointment letter

-

Recent payslips

-

Tax return showing judicial status

-

🔍 Tip: These changes broaden eligibility and reduce income barriers — great news for early-career professionals and returning customers.

Great Southern Bank Policy Update

-

Discharge Form Now DocuSign Enabled

📄 Our discharge form is now available via DocuSign for faster, easier processing.

👉 Important: Your customers must contact our Retention Team directly to access the form. -

Home Guarantee Scheme – Updated Retained Savings Limits

-

💵 $23,000 can now be retained after settlement for customers purchasing an existing property

-

💰 $33,000 can be retained for new build purchases

-

To learn more about how your clients can take advantage of the Home Guarantee Scheme with Great Southern Bank, visit our Broker Portal.

NAB HECS/HELP Servicing Policy Update – Effective 31 July 2025

Big win for borrowers with smaller student debts! 🎓💰

From Thursday 31 July 2025, NAB will now allow HECS/HELP repayments to be excluded from servicing — but only if the total debt is $20,000 or less, and only when needed to make the deal work.

✅ What You Need To Do:

-

Include the full HECS/HELP liability and repayment in the loan application as normal.

-

If servicing is tight, upload:

-

A screenshot or PDF from the client’s ATO portal showing the HECS/HELP debt is $20,000 or under

-

A broker note stating: “Servicing is based on HECS/HELP debt being excluded.”

-

-

NAB’s credit team will apply a servicing override at assessment time.

📌 Note: If your deal doesn’t need this workaround, continue lodging HECS/HELP as per standard process. This override is only for borderline servicing cases.

👏 A small change that could mean big approval wins — especially for younger or first home buyers juggling smaller student debts.

ANZ Policy Update – Effective 28 July 2025

-

Company Wages Policy for Self-Employed Borrowers

Effective 28 July, ANZ is updating Mortgage Credit Requirements to provide greater clarity around eligibility for the Company Wages Policy.✅ This policy applies to self-employed borrowers who:

-

Pay themselves a regular wage from their company

-

Do not require LMI

✅ Eligibility Criteria:

-

The business must be a Pty Ltd company

-

The company must have individual shareholders (not companies or trusts)

-

The borrower must beneficially own shares directly (not just in name or via another entity)

-

An ASIC search must confirm direct shareholding

-

ATO Income Statement must show the company as the employer

❌ Not Eligible Under This Policy:

-

Sole Traders

-

Partnerships

-

Trusts

-

Companies with non-individual shareholders

📄 Documents Required:

-

ATO Income Statement covering min 6 months YTD

-

One payslip dated within 60 days of statement of position

-

No other financials or tax returns required

-

-

Switching RIL to OO – Policy Update

From 11 August 2025, switching from a Residential Investment Loan (RIL) to an Owner Occupier (OO) loan within 12 months will require a credit critical assessment. -

Director Fees and Company Dividends (DFCD)

From 28 July 2025, only the latest year of income docs are needed.-

Include with taxable income if verified

-

Use exact wording ‘Director Fees’ in notes

-

AMP Bank’s Bold Move: Launching a Game-Changing Broker Platform with Simpology

What a privilege it was to host the launch of AMP Bank’s brand new broker platform, built in collaboration with Simpology.

This wasn’t just another tech release — it was a powerful demonstration of what happens when a lender chooses to lead instead of follow. AMP Bank made it clear: they don’t intend to swim in the sea of same.It was obvious this was a bold and ambitious move — AMP has designed their broker lodgement platform with industry-leading tech partners from the ground up, with brokers and customer and the centre of everything.

🧠 Digital First. Broker Focused. Customer Centric.

-

Digital first — no more clunky back ends

-

Broker focused — tools that fit how brokers work

-

Customer centric — more time for clients, less admin

⚡️ Game-Changing Pre-Verification

Built right into the front end, before submit:

-

Less time chasing paperwork

-

Less ping pong with assessors

-

More time building client relationships

🎤 Broker Reactions

Brokers who were involved in the pilot were genuinely excited: faster approvals, transparency, and feeling heard.

📣 Long-Term Broker Support

This isn’t a one-off launch — AMP Bank is backing brokers for the long haul.

🙌 My Message to Brokers

If you haven’t tried it — do yourself a favour and give it a spin. It speaks for itself.

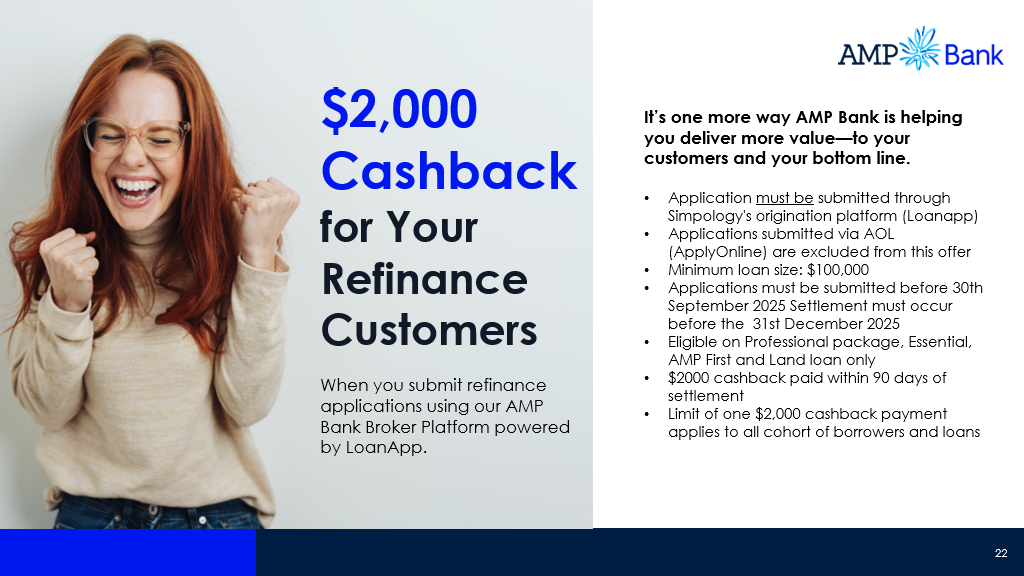

💰 New AMP Offer – $2K Cashback

Submit a refinance via the new platform before 30 Sept 2025 and your client gets $2,000 cashback.

✔️ Gain access to AMP Bank Broker Platform

✔️ Submit via new LoanApp-powered system

✔️ Lodge before 30 Sept 2025

Start training here: AMP Training Hub

🛠️ ME BANK Home Renovation Cash Out? ME Bank’s Got You Covered

Looking to help clients access funds for non-structural home improvements?

Here’s what ME offers:

-

✅ Cash out up to $750K with no formal quotes or invoices required (non-LMI only)

-

✅ $3,000 refinance cashback on loans over $700K

Support your clients’ renovation goals with a lender that keeps it simple. Speak to your ME BDM or log in to the broker portal to learn more.

ME Bank Offering a Smarter Way to Help with LMI

For clients who’ve saved (or been gifted) a 5% deposit and covered costs like stamp duty and legal fees — but are still short on LMI — there’s a better option than turning to the Bank of Mum and Dad for a full deposit or guarantor support.

Introducing LMI Family Assist

An affordable solution that allows a family member to contribute just the LMI premium — a much smaller outlay than a full deposit or equity pledge.

Key Benefits:

-

Smaller contribution, bigger impact: Family gifts only the LMI premium

-

Dual discounts available:

-

15% off the LMI premium (when paid upfront)

-

First home buyer LMI discount*

-

Eligible borrowers can access both discounts combined

-

-

Flexible eligibility:

-

Available to FHBs even if they’ve previously owned an investment property

-

Only one applicant needs to meet the FHB criteria

-

Supports up to 95% LVR, including non-genuine savings and LMI

-

Variable rate options available — with renegotiation after 12 months

-

Note: Additional conditions may apply for higher-risk postcodes.

Want to Learn More?

Reach out to your ME BDM or visit the broker portal to see how LMI Family Assist can open the door for more first home buyers.

📣 Advantedge Update

-

🚫 No New Applications from 30 September 2025

Go Edge will stop accepting new home loan applications from 30 September 2025. -

🔁 Existing Loans to Migrate in 2026

All existing Go Edge home loans will be migrated to a NAB-branded loan in 2026.

💬 Stay tuned for more details as the transition approaches.

🏦 Bank of Melbourne

🔗 Offset Account Linking Limit – Effective 5 August 2025

From 5 August 2025, customers will be able to link a maximum of 10 eligible transaction accounts to an eligible home loan.

-

✅ Any signed and returned requests received before this date will still be honoured.

✉️ Letters Sent to Customers – Effective 8 September 2025

Customers with more than 10 offset accounts linked to a single loan account will receive a letter advising:

-

The 10 offset accounts with the highest closing balances will remain linked

-

Any other offset accounts will be de-linked from Wednesday, 23 October 2025

💸 Repayment Pause → Now Called Reduced Repayments

📉 Changes Effective 18 August 2025

The new Reduced Repayments feature allows eligible customers to reduce repayments by up to 50% of the minimum amount on principal & interest loans only.

-

❌ Customers will no longer be able to pause repayments entirely or request $0 repayments under this feature.

⚖️ No changes apply to:

-

Customers with an existing Repayment Pause

-

Customers using the Repayment Holiday feature

📝 Eligibility for Reduced Repayments is subject to updated credit criteria from 18 August 2025.

-

✅ Any signed and returned customer requests before this date will continue to be honoured.

NOT A MEMBER YET?

Join today with a 14-day free trial — month-to-month, cancel anytime.

Individual memberships start from $57 + GST per month and give you 24/7 access, on desktop and via our mobile app, plus your always-on research sidekick BrokerChat.AI.

Smarter research. Faster answers. Less stress.

What are you waiting for?