The Brokers' Bible BIG NEWS 🌟📢

🚨 Big News! 🚨

I’m beyond excited to share that… The Brokers Bible has officially been acquired by LMG! 🎉👏

When I first built The Brokers Bible, it was never about me — it was about you. I wanted to create a go-to resource that brokers could rely on every single day. A smarter way to work. A faster way to find answers. A platform that actually gave you back your time.

And while I’ve poured my heart, soul, and probably too many late nights into it… to take TBB to the next level, I knew I couldn’t do it alone.

This move is so important — because The Brokers Bible is bigger than me, and I want it to become so much bigger than me.

Here’s what it means for you:

✨ You still get me (don’t worry, I’m not going anywhere!)

💪 I now have an incredible team backing the platform

🔧 I’ve got more resources to improve functionality

🧠 I’ve got tech minds with skills I could only dream of

Over the next 6 months, I’ll be working closely with LMG’s tech team to pimp things up — better search, better tools, better broker support. And as always, I’m here to serve you and your business.

Thank you for backing me so far — the next chapter is going to be even bigger. 🚀

Let’s build this thing together.

Kath x

💼 BIZCAP

📢 Our Line of Credit offering is now up to $750K Unsecured!! 💰🚀

🏢 Bankwest

📍 For purchase or refinance of properties in inner-city Melbourne (and across Australia).

🆕 What’s New:

✅ Increased maximum LVR for existing high-density units in 77 postcodes from 90% to 95% (inclusive of LMI) for Owner Occupiers.

✅ For non-high-density residential units (≥ 40 sqm):

-

Owner Occupiers: LVR increased to 98% (from 90%)

-

Investors: LVR increased to 95%

✅ Off-the-plan units: LVR increased from 85% to 90% for both Owner Occupiers and Investors.

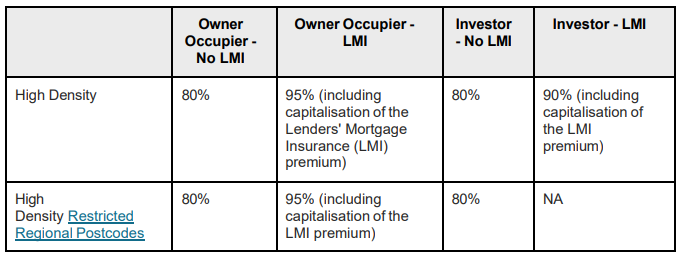

🏗️ High LVR Lending for Apartments:

Bankwest continues to offer high LVR options for apartments, including those typically restricted by other lenders.

👉 Definitions & Maximum LVRs below:

🔸 High Density Definition:

An apartment/flat that:

-

Is not detached or semi-detached

-

Exists within a development of 6+ floors or more than 50 accommodation units

🔸 Minimum Requirements:

✅ Must:

-

Have ≥ 40sqm living area (excluding balconies)

-

Include at least one separate bedroom

🚫 Cannot:

-

Be off-the-plan or a developer sale

-

Be <40sqm

-

Be student accommodation or serviced apartments

- Student accommodation

🧡 ING – Buy Now, Live Later

🎯 Supporting savvy first home buyers choosing to invest first, rent where they live.

💡 Flexible options like:

🏠 Family Support Loans

👥 Property Share Loans

👨👩👦 Family support:

- Available for Principal & Interest repayments only.

- First mortgage over both the guarantor’s property and the new property purchased.

- Borrowers must be able to show they can service the loan on their own.

- Guarantors must not be placed in a position of hardship and will require legal advice and may require financial advice in relation to the guarantee.

📘 Example:

Son wants to buy an Investment Property after returning from overseas.

✅ He can service 100% of the loan

🏡 Parents offer equity in an Investment Property to support

📄 Only one application with one loan is required to be submitted with one applicant and parents as guarantor.

🧾 Property share

We’re one of the few banks that offers a property share loan structure that’s:

- Tailored structure – Built around each borrower’s needs.

- Versatile – Fits any joint ownership scenario

- Investor-friendly: Pool resources, keep finances separate.

Here’s another scenario:

Brother and sister are purchasing an investment property for $980,000 under a property share loan structure at 80% LVR.

Two applications will be submitted:

- Sisters loan $392k (brother is a guarantor)

- Brothers loan $392k (sister is a guarantor)

Total loan across two applications is $784,000.

Serviceability is assessed separately in each application. Brother must be able to service his loan only with only his income/living expenses and commitments, similarly the sister must service her loan with her income/living expenses and commitments.

🏦 MyState

📅 From Monday 28th July 2025, NextGenID is mandatory for all new submissions.

⚠️ Key Things to Know:

-

No need to upload ID separately 🙌

-

Auto-fills ID details into AOL

-

Must provide valid passport or licence (must be current at settlement)

-

Must verify full legal name, DOB, and residential address

☕ Coffee & Credit with The Brokers’ Bible – Free Webinar

🗓️ Thursday 17th July – Register now!

💬 Topic: Low Doc Lending – Who Actually Does It?

✅ What docs your clients really need

✅ Lenders that genuinely offer low doc

✅ How to prep for one-touch approvals

✅ Common traps that trigger declines

👯♀️ Perfect PD + team catch-up. Don’t miss it! Register HERE:

🏆 We’re Finalists – 3x Australian Broking Awards! 🥳

I’m so honoured (and still a little shocked) to share that The Brokers’ Bible and I are finalists in three incredible categories at this year’s Australian Broking Awards:

🌟 Industry Thought Leader of the Year

🌟 Technology Service Provider of the Year

🌟 Innovator of the Year – Company

To be honest, I started The Brokers' Bible because I knew brokers needed a better way to work — smarter, faster, and with way more confidence. I never imagined this little idea would grow into something that’s now recognised alongside the biggest names in our industry (who have inspired me along my journey).

So much heart, hustle and late-night policy uploads have gone into this platform — but more importantly, it’s been shaped by the incredible community of brokers who’ve supported, challenged, and inspired me every step of the way. You’re the reason it exists.

Thank you to everyone who’s shared feedback, joined as a member, or just cheered me on from the sidelines. And thank you to the judges for seeing the potential in this work — it truly means a lot.💛

🖥️ AMP Broker Webinar – New Custom-Built Platform Launch

📆 Wednesday 30 July 2025 | 🕚 11:00am–12:30pm AEST

🎓 1.5 CPD hours

✨ A first-of-its-kind platform, co-designed with brokers!

🎯 Real-time credit policy checks

⚡ Issue loan docs in 90 seconds

👀 Full visibility + faster time to yes

📌 Built on Loanapp V2

💬 Hear direct from pilot brokers

📲 Register now to be the first to see what’s coming!

Register here 👈👈👈👈

NOT A MEMBER YET?

Join today with a 14-day free trial — month-to-month, cancel anytime.

Individual memberships start from $57 + GST per month and give you 24/7 access, on desktop and via our mobile app, plus your always-on research sidekick BrokerChat.AI.

Smarter research. Faster answers. Less stress.

What are you waiting for?