Weekly Kath's Credit Crunch 16th June 2025 🌟

🚀 Apollo (by Athena for LMG)

📺 Watch more updates HERE

👉 Where applicants have less than 50% care of dependents, brokers are not required to enter them into the application — just include any extra costs they may have for them under expenses.

❌ Advantedge

🛑 Now exiting the market — a disappointing loss of this white label product.

📆 Over the next 12 months, all customers with Advantedge products will migrate to NAB branding.

🏦 NAB

🔐 VOI & KYC Updates

NAB has transitioned from IDyou to InfoTrackID for all new customer identity verification services.

Here’s what you need to know:

-

You should have received your new account details from InfoTrack.

-

If you were using IDyou, your account should’ve been automatically provisioned.

-

Look for a welcome email from @infotrack.com.au — it contains your unique login credentials.

📉 Adjusting Repayments (Post-Rate Cut)

🗓️ From Monday 16 June, eligible customers will be able to adjust their minimum home loan repayments via the NAB App.

📱 This makes it easier for clients to manage their repayments directly from their phone or tablet.

🏡 ANZ

💰 LMI Premium Pricing Reduction

📆 Effective 23 June 2025, ANZ will reduce LMI premium rates for specific LVR and loan amount bands.

What’s Changing:

-

📉 LVR >80% – ≤95% AND Loan Amount >$500k – ≤$600k

-

📉 LVR >90% – ≤95% AND Loan Amount >$600k

Inflight Applications:

-

✅ New rate applies for apps not fully approved by 23 June

-

🚫 Old rate remains for apps approved before 23 June

📅 Events: NAB Economic Update Webinar

You’re invited to a live discussion with Sally Auld, NAB’s Chief Economist.

🎙️ Host: Chris Thomas, Executive, NAB Commercial Broker and Equipment Finance Sales

💬 Includes live Q&A + CPD Points available

🗓️ DATE: Wednesday, 25 June 2025

🕛 TIME: 12:00 PM – 1:00 PM AEST

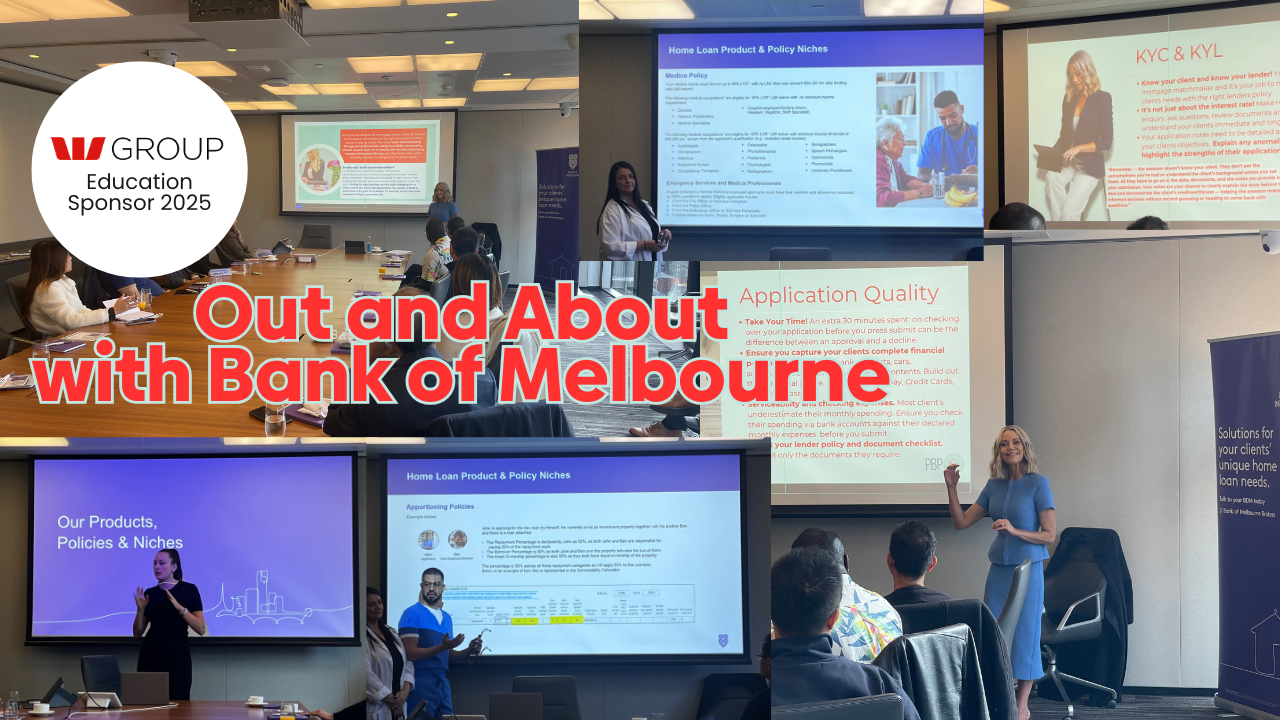

🚨 Busy Few Weeks in Broker Land – and I'm Loving It! 🚨

The past few weeks have been a whirlwind — but packed with all the good stuff 🙌

✨ First up – a big warm welcome to the Westpac Group as our newest Educational Sponsor for The Brokers’ Bible!

We love their niche policy strengths, and I was incredibly privileged to be invited to speak at their latest New Broker Induction session. I shared some insights (and real talk!) on what brokers can expect in those first few years of business.

We also heard from the amazing Bank of Melbourne BDMs and Credit Team who gave us the lowdown on some of their standout policy offerings. A few of our faves👇

🔹 Extended LMI Waivers – including Nurses, Midwives and a wide range of medical professionals 💉

🔹 Common Debt Reducer – their unique apportioning policy that helps get tricky deals across the line

🔹 FastTrack Self-Employed Policy – 2 years NOA = income verified. Simple, clear, and fast (our fav) ✅

🔹 Parental Guarantee Policy – flexible, client-friendly, and still a massive value add for family-assisted buyers

💬 LMG - Meet the CEO Event - Ewen Stafford

Last Thursday I had the pleasure of attending the LMG Meet the CEO event in Melbourne.

The goal? Not just to showcase the exciting upgrades coming over the next 12 months, but to really listen.

Each presentation included an open and anonymous Slido questionnaire, designed to capture authentic feedback, suggestions and broker pain points — nothing was off-limits.

👏 I loved seeing such a genuine commitment to broker input, and the vibe in the room was electric — real collaboration and energy.

And the cherry on top? Catching up with LMG’s incredible leadership team and meeting some of our amazing Brokers’ Bible members in person. Thank you for having me LMG!

See you next week finance friends!!

NOT A MEMBER YET?

Join today with a 14-day free trial — month-to-month, cancel anytime.

Individual memberships start from $57 + GST per month and give you 24/7 access, on desktop and via our mobile app, plus your always-on research sidekick BrokerChat.AI.

Smarter research. Faster answers. Less stress.

What are you waiting for?