Weekly Kath's Credit Crunch 21st July 2025 🌟

💥 Last Week: What. A. DOOZY.

Still catching my breath from the absolute whirlwind that was the announcement of LMG acquiring The Brokers’ Bible 💙

The response? Honestly, I’m overwhelmed (in the best way) — the messages, the support, the love from brokers, BDMs, and industry mates has been nothing short of incredible. This move is more than business — it’s about backing brokers, scaling what works, and building the tech and tools that make a real difference (yep, we’re just getting started 😉).

To everyone who reached out — thank you. To the LMG crew — let’s GO. And just when I thought that was enough to process, I reached another milestone of my career!

💰 $500 million in reward and recognition handed out across the LMG network. It’s humbling, mind-blowing, and deeply motivating to be part of a group that walks the talk when it comes to backing its people. Thank you for a wonderful night.

Lender Spotlight:

Earlier this year, we welcomed Paramount Mortgage's as a lender education partner and today we wanted to highlight just why we love them!!

Paramount is a niche, non-bank lender specialising in alt doc, non-code, commercial and rural solutions — the kind of deals mainstream lenders often shy away from. They shine when things get tricky.

🧩 What They Do Best:

✅ Lo Doc Lending (Residential & Commercial)

Up to 85% LVR with flexible income verification (accountant's letter or 6 months BAS). Great for self-employed borrowers, newly established businesses (even with 6-month ABNs), or clients with non-traditional income.

✅ Specialised Security Types

Got an unusual property? Paramount accepts pubs, childcare centres, boarding houses, farms, vineyards, medical centres, golf courses and more.

✅ Construction & Development Loans

-

Single & Duplex Builds (Lo Doc)

-

Multi-dwelling and incomplete builds

-

Land subdivision and development up to $20M

-

No presales often accepted

-

Owner builder permitted on select deals

✅ Rural & Agricultural Lending

Funding available for lifestyle properties, hobby farms, vineyards, and working farms with unlimited acreage — even cannabis and cattle operations considered.

✅ Bridging & Caveat Loans

Short-term funding up to 80% LVR, quick turnaround (48–72 hrs), with minimal doc options and interest-cap structures. Great for urgent refinances or sale-based exits.

✅ Jumbo & Non-Code Commercial Loans

Loans up to $15M+ with flexible terms, commercial or industrial zoning accepted. Also cater to asset-backed cash out, working capital, and business expansion.

✅ Vehicle & Equipment Finance

Lo Doc options for business vehicles, trucks, trailers, excavators — including buy-back and expansion loans. Fast turnaround and minimal paperwork for GST-registered ABNs.

✅ SMSF Lending – Up to 90% LVR

For residential purchases and refinances within SMSFs. Clean credit required, but flexible servicing and documentation accepted.

📍 Bonus Broker Wins:

-

Defaults often considered

-

No clawbacks

-

Commissions up to 1.1%

-

Nationwide lending – metro & regional

-

Fast settlements: as quick as 2–3 business days

Perfect for:

🚧 Complex scenarios

🚜 Rural & agricultural borrowers

🧾 Self-employed or Lo Doc clients

🧱 Developers & short-term construction

🧨 Urgent bridging or cash-out needs

🧳 Clients with out-of-the-box property or structure

🔔 AMP Product Update – Simplification of Home Loan Range

Effective 31 August 2025, AMP will be retiring its Basic and Select Home Loan products for new customers as part of a strategic move to simplify its lending offering.

✅ What Brokers Need to Know:

-

No impact to existing customers – current clients on Basic or Select loans will remain unaffected, and no action is required.

-

AMP will communicate directly with these customers from Tuesday, 29 July 2025.

🔍 Why the Change?

-

This forms part of AMP’s broader strategy to reduce complexity and align with evolving market needs.

-

It supports AMP’s transition from ApplyOnline to Simpology, focusing attention on their three core products:

-

Professional Package

-

Essential Loan

-

Land Loan

-

This streamlining will help create a more efficient and consistent experience for both brokers and customers.

⚡ AMP Bank Streamlines Income Verification with Equifax

AMP Bank has partnered with Equifax Verification Exchange® to enable real-time digital PAYG income verification — no payslips required.

This new integration:

-

Delivers faster approvals

-

Reduces broker touchpoints

-

Ensures accurate, compliant data

Part of AMP’s new broker platform rollout, this upgrade supports faster, simpler lending outcomes for brokers and clients alike.

🚨 You're Invited! AMP's New Broker Platform 🚨

Hosted by yours truly — and you won’t want to miss this one. I’m so excited to invite you to an exclusive session where we’ll lift the lid on AMP all-new, custom-built broker platform — the first of its kind in Australia.

📌 This isn’t just a platform upgrade — it’s a total reinvention of how brokers work with lenders. Built with brokers on Loanapp V2 and packed with smart tech that genuinely reduces the time and stress in getting deals done.

👀 What you’ll see:

✅ Real-time credit policy checks and income/expense verification — before you hit submit

✅ VOI reuse via IDVerse — A LexisNexis® Risk Solutions Company

✅ Loan docs in 90 seconds (yes, really)

✅ Full visibility & control from submission to settlement

✅ A consistent, smarter process = less rework, faster time to YES

🎙 Who you’ll hear from:

🔹 Sean O'Malley, Michael Christofides & Paul Herbert from AMP Bank on the strategy and commitment to broker innovation

🔹 Melissa Christy – a deep dive into the platform’s game-changing features

🔹 The amazing tech partner panel – Simpology Australia, Fortiro, Equifax, and Cotality Australia (formerly CoreLogic) share how their tools power the back-end

🔹 Real broker voices – insights from brokers who’ve been hands-on in the pilot

📅 Wednesday 30 July

🕚 11:00am – 12:30pm AEST

🎓 1.5 CPD hours

📍 Online - Free🔗 👇👇https://events.amp.com.au/pub/pubType/EO/pubID/zzzz68611a7671f7b896/interface.html

Built for brokers. Backed by AMP. Powered by some of the best in fintech.

Let’s go. 👊

Westpac and Bank of Melbourne completed part 1 of their Self-Employed Series, register now to join us for Part 2!

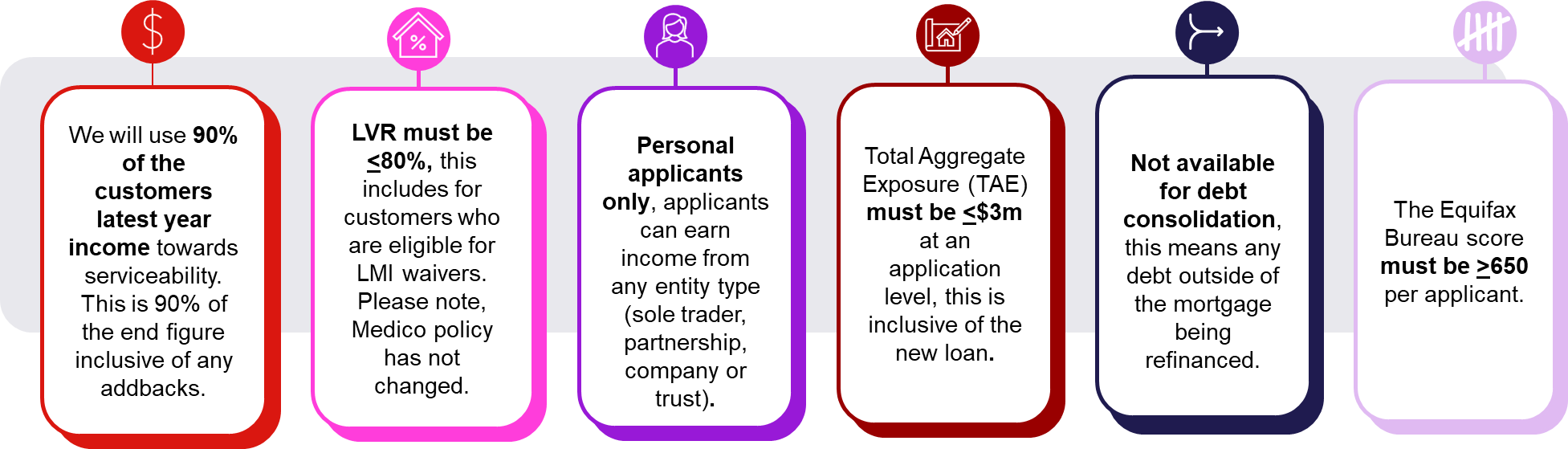

From our wonderful Westpac BDM: We hosted Part 1 of our Self-Employed Series on Thursday 10 July and it was awesome to see so many of you there. If you want to rewatch the session, there is a recording available on BrokerHub and CPD points (MFAA & FBAA) are included in the recording. Some key takeaways from the session for me were:

Our new 1-Year policy really is that good – it is essential to remember the criteria, as there will be no exceptions to it. If you need to print this out, stick it on the fridge, use it as a place mat at the dinner table or in your kids school bags.

And don’t over supply docs! We only need the latest year personal ITR and NOA and any entity TR and balance sheet (ONLY!).

Fast Track could still be the favourite child – as good as the new 1-Year policy is, Fast Track is still a contender for favourite policy. this can be used for any and every application type as long as the LVR is <80% (except Medico Group A who can go up to 95% using Fast Track).

If there’s a flow flow, it’s a no no – when using our Simple Solvency Check (SSC) to exclude a business from your customers serviceability, we can accept a customer declaration where there are no inter-entity flows. You simply need to enter what the customer has told you in the notes in ApplyOnline.

Put your BDM’s number in your favourites – as your BDM, I am obsessed with making sure your experience with Westpac is amazing. Whatever the question is, please reach out and I’ll help you find the answer.

Bank of Melbourne and Westpac New Self Employed Policy Webinar #2 Register below:

|

📢 Brokers, Did You Know?

ATO debt is rising — and so are the consequences. From 1 July 2025, ATO debt will no longer be tax deductible for businesses. On top of that, the ATO now has the power to lodge judgments against individuals with debts over $100k that are 90+ days overdue.

🚨 That means serious implications for credit files — and potential roadblocks to finance approvals.

This is your cue to start the conversation with clients about:

-

Managing or consolidating tax debt

-

Exploring alternative lending solutions

-

Collaborating closely with accountants and referral partners

💡 The good news? We’ve got smart lender options and support tools inside The Brokers’ Bible to help guide those conversations — and those deals.

Don’t wait for clients to get stuck — get ahead of it now.

🔔 Credit Crunch Friday is Coming!

Starting next week, your weekly Credit Crunch update is moving to Fridays!

Why the switch?

Because we get it — Mondays are chaos.

📌 Client weekend purchases

📌 Team meetings

📌 100 unread emails and a triple-shot latte

And the last thing we want is for you to miss the gold we spend hours pulling together for you.

Fridays?

They’re calmer, more cruisy — and perfect for wrapping up the week with everything you need to know:

✅ Policy changes

✅ Lender updates

✅ Broker hacks & hot tips

So, starting next week, wrap your week with Credit Crunch Friday — and finish strong. 💪

NOT A MEMBER YET?

Join today with a 14-day free trial — month-to-month, cancel anytime.

Individual memberships start from $57 + GST per month and give you 24/7 access, on desktop and via our mobile app, plus your always-on research sidekick BrokerChat.AI.

Smarter research. Faster answers. Less stress.

What are you waiting for?